While most customer experience solutions are still asking the user to press a key on their phone, fast movers are providing real automated AI support creating loops that create continuous learnings, add value to each interaction and help better train humans in customer support.

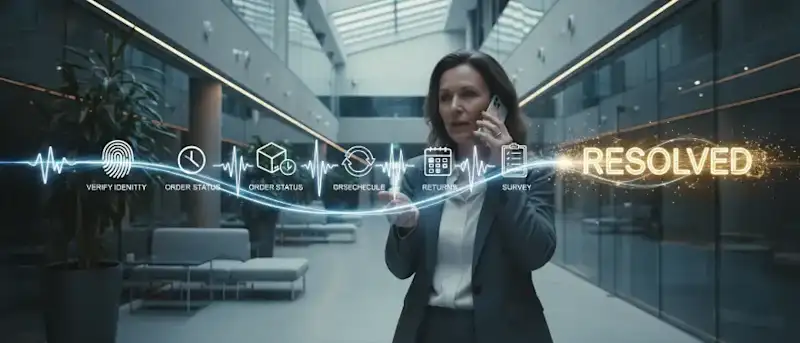

Voice AI for customer experience turns conversations into insight you can ship improvements from, speeding answers, personalizing help across channels, and lowering effort without losing the human touch. It recognizes intent, retrieves the right context, and routes the next caller to the right answer faster.

Customer experience and Artificial Intelligence, aligned, cut handle time, raise CSAT, and keep compliance intact. You will get a blueprint to launch a small pilot, the measures that prove real gains, and the path to scale with confidence.

Why is customer experience and AI suddenly the same conversation?

Customers do not separate service from product anymore. The moment you answer the phone, reply in chat, or send a follow-up, that moment is the product. AI finally lets you shape those moments in real time, at scale, without turning your operation into a script factory. The change you can feel is lower latency, higher quality, and clean hooks into your stack so the experience is consistent across channels.

Leaders see the same shift at the market level, with 62% of executives saying generative AI will disrupt how their organizations design experiences, and 85% of customer service leaders planning to explore or pilot customer-facing conversational GenAI this year.

The short version before we dive in: ultra-responsive voice and text agents can hear context, adapt tone, and act inside your systems. They collect clean feedback, summarize what matters, and close loops. Do this well and customers stop feeling processed, they start feeling helped. This is the practical heart of customer experience and AI.

Think of value through two lenses: what improves cost, revenue, and quality for customers, and what is feasible given your data, skills, and adoption. That value-versus-feasibility view helps choose where to start and what to stage next.

The ecosystem caught up too. Industry players have shipped pieces of this—agent guidance, call summaries, real-time profiles. To ground that trend, see Amazon Q in Connect for agent guidance, real-time recommendations during calls/chats, and post-contact summaries to finish notes for you; Google documents Agent Assist summarization for chat and voice. Good signals for the market.

Dasha bundles these capabilities into one tightly engineered stack: low-latency speech, context memory, and policy-aware tools that act in your systems. No duct tape. No swivel-chair.

How to introduce AI in customer experience?

Start where value is provable and risk is low: agent assist, case summarization, and simple, high-volume intents. Gartner classifies these as the “likely wins” for service AI because they are both high-value and highly feasible. Treat them as phase one. Stand up summarization and guidance inside current workflows, then automate the clearest intents customers already ask for every day.

Put a copilot on every interaction first. Summaries and next-best-actions reduce wrap-up time and make handoffs clean. Teams that deploy AI for this see shorter handle time and faster training curves; Forrester’s TEI work on modern contact centers reports 120 seconds off AHT and AI agents containing up to 28% of contacts, which funds further automation.

Automate bounded intents with real volume. Start with order status, delivery changes, password resets, appointment scheduling, plan changes within policy, and returns initiation. Klarna’s production assistant shows what “narrow but valuable” looks like at scale: two-thirds of chats handled, human-level CSAT, fewer repeat contacts, and minutes instead of eleven to resolution. That is the pattern to copy before you tackle edge cases.

Layer in proactive service next. Use events from your stack to prevent contacts: “package delayed,” “payment failed,” “trial expiring,” “warranty step due.” McKinsey’s 2025 survey finds more orgs are now capturing direct revenue lifts in the units deploying gen-AI, which aligns with proactive outreach that rescues renewals and reduces avoidable tickets.

Harden the knowledge backbone in parallel. Let AI index, tag, and refresh the help center and macros, then score answer quality against QA rubrics. Forrester highlights conversation analytics and faster knowledge creation as core operational wins; this stabilizes answers before you scale containment.

Expand only when the basics are green. After assistants, summaries, and top intents are steady, move to calculated-risk areas like multilingual real-time support and fully agentic flows that complete transactions end-to-end. Adoption data supports the trajectory: most CX leaders report AI is already making digital interactions more efficient, and investment plans are accelerating.

How to pick the very first slice in your org: choose a journey with high contact volume, a clear policy path, and measurable outcomes customers feel—faster resolution, fewer repeats, cleaner follow-ups. Prove it in one queue, publish the deltas weekly, then replicate to the next two intents.

Where does conversational AI voice fit within the field of customer experience?

Fix feedback first. Capture one-to-two natural questions at resolution, log structured fields plus a short summary, keep transcripts for training, and map to your taxonomy. Keep brand voice and avoid leading prompts.

Make CRM the single source of truth and action. Read one profile, then update fields, create tasks, issue returns, and book slots with audit trails. Kill swivel-chair work and reduce repeats. Pair with knowledge that AI tags, refreshes, and retrieves so answers stay consistent.

Start with use cases that pay back in weeks: payment retries, expiring trials, contract reminders, delivery confirmations, address fixes, slot rebooking, return initiation, and two-question surveys that route to an owner. Retail sees fast gains here across OMS/WMS, CRM, and carrier APIs.

Go multilingual when the basics are green. Modern speech improves barge-in, diarization, and code-switching, so one assistant can handle accents and language changes without new playbooks.

Experience Dasha live demo now - click "Ask Dasha" button in top right corner!

Designing, Measuring, and Governing AI in Customer Service

Design for human rhythm. Allow interruption, recover gracefully, keep context. Use short sentences for high-stakes moments and longer ones for guidance. Write patterns, not a thousand intents. Teach clarify → confirm → close.

Measure what customers feel and ops can prove. AHT down (carefully), FCR up, context-rich transfers up, survey response up, refund abuse down, agent ramp time down. Watch language shifts: fewer “I already told you this,” more “that was quick.”

Keep teams in the loop without overload. Live assist in-call, one-click send of AI-drafted snippets, clean escalations with summaries and suggested next steps. Training moves from scripts to patterns.

Use a layered architecture. Fast speech for voice, a reasoning layer grounded in policies and data, a tools layer with scoped permissions to act in your systems, and analytics that turn conversations into themes stakeholders can ship against. Minimize PII flow. Log only what you must.

Avoid common traps. Don’t launch everywhere. Don’t measure deflection alone. Prevent policy drift. Treat the agent like a teammate with feedback and a clear mandate.

What good agents sound like. Quick greet, low-friction verification, one smart clarifier, no filler, plain-language summaries, precise next steps, tidy close.

What will change in CX over the next 12 months?

Three shifts are already underway.

We’ll move from pilots to real experiences, with higher automation rates, especially in voice, as vendors ship more capable agents and enterprises wire guardrails. Salesforce is public about rising agent autonomy and voice-first capabilities.

Human roles will move up-stack, as agents spend more time on complex care, exceptions, and relationship-building. Skills like EI and tool fluency will become more valuable for customer experience staff.

Outsourcing mix shifts. As simple contacts automate, contract models change. Forrester forecasts significant disruption to traditional labor-arbitrage models

Expect in-person experiences to rise and big players spend to build additional trust. Some AI firms are using pop-ups to humanize tech — an indicator others will follow.

Deploying AI CX in practice

At Dasha, we build voice agents that pass the “talk time” test: sub-second latency, barge-in, and policy-safe retrieval. Two patterns consistently produce ROI:

Intent-level containment with graceful handoff. Let a Dasha voice agent handle status, bookings, and policy-bound tasks. If confidence, latency, or tone slip, hand off to the human queue with full context in the CRM. Measure FCR and AHT changes directly.

Copilot everywhere. For agents, provide Dasha-style call summaries, next best action, and knowledge snippets inline. Don’t make them hunt. Instrument prompts and responses with evals. You will see QA pass rate and handle time move.

Workflow redesign and governance separate leaders from the pack. AI copilots and autonomous service drive measurable ROI. Those are the same levers you pull with disciplined voice and chat deployments.

Upgrade Your Customer Experience with Real Voice AI

See how Dasha transforms customer calls into faster, smarter, and more human conversations.